+Stan Pedzick's too much turkey broth almost simmering.

{ 0 comments }

Happy 4th Anniversary to my fabulous husband. can’t believe how time has flown. (For our visit to Garden of the Gods last weekend.)

{ 0 comments }

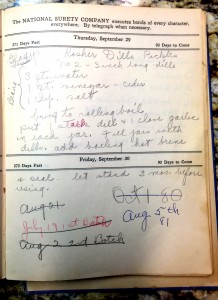

So this recipe isn’t all that different in its ingredients, but I do love the shorthand at the bottom of the page. This is from my Grandmother Emily’s cookbook in the Lawyers Calendar. It came to her from someone named Gladys Laub(not anyone I knew).

No. 2 – 3 inch long dills (I think she means cucumbers)

3 qts water

1 qt vinegar – cider

1 cup salt

Bring to a rolling boil. Put 1 stalk dill & 1 clove Garlic in each jar. Fill jars with dills (cucumbers). Add boiling brine & seal. Let stand 3 months before resing (sp? I have no idea).

Below the recipes are the dates for the various batched she made, so she would know when they were ready to eat. The last one was Aug 5th, 81, The summer before I started college at Pomona. I don’t remember this recipe when I was very young, so she picked it up later in her life, though she had canned and picked things for her whole life. I do remember that these were very good – nothing like the ones from the store at the time.

{ 0 comments }

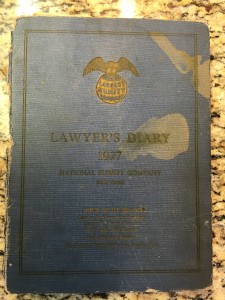

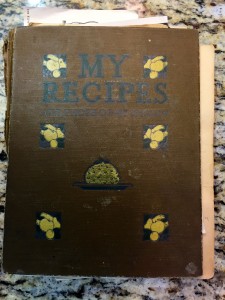

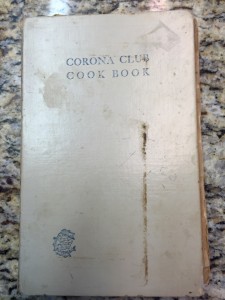

During at discussion over the Christmas holidays, I was talking about some of the unusual recipes from my family’s cookbooks. I have two from my grandmother (paternal) as well as one from her mother. We also have two from Stan’s mom and grandmother. The two below were my grandmother’s and the one the lower row was my Great-grandmother’s. The ‘My Recipes’ book has blank pages under headings for the owner to write in their own recipes. The Lawyer’s Diary has half pages with dates that my grandmother used as a blank pages. The “Corona Club Cook Book” has recipes, but lease several black pages at the end of each chapter for you to ad your own. I thought it might be interesting to post some of the most usually recipes from these books.

I thought I’d start with one of the recipes that I never sampled, but that I find interesting. It’s called Spring Tonic and it’s described as being Mary William’s recipe (my Great grandmother). Which means it must date from the late 1800s

The ingredients are 10¢ Sarsaparilla Root, 10¢ Dandelion Root, Stick of Licorice, 1 Qt of Water.

The instructions are Boil to Pint, Strain, Add one Teaspoon Epson Salts. Shake Well. Take wine glass morning

I have trouble imagining the value of such a concoction and even more trouble wondering about its flavor. I also wonder how much 10¢ of the two roots would have been. The non grammatical sentences must have been a form of shorthand for my grandmother, since she never spoke this way. Although some recipes in the book have only ingredients (an issue I’ve had to deal with before). But for today – Spring Tonic.

{ 0 comments }

So, after my last post, one of my friends asked for a checklist. I got such a list from the lawyer after Jo Ann died, but I found it incomplete and poorly written. So after looking around, stealing some verbiage from another source (AARP), pulling together things that we learned that I didn’t see anywhere else, and adding suggestions from friends, I do have such a list.

Caveats –

So without further ado, the list. A link to a pdf is listed at the end, so you can take it with you.

Documents and other Items to Gather Upon Death

If you have a scanner, scanning document makes them much easier to convey. Most agencies will work from an emailed copy or will return an original to you. The one other document that you may need certified copies of is Letters Testamentary, which gives the Personal Representative their power over the estate. Many agencies will make a copy if you let them see the original (our bank seemed to work this way).

What to do when someone dies

Immediately after death

Arrange for organ donation. It may be the last detail you want to think about, but arrangements need to be made almost immediately at death. Not certain about the person’s wishes? Two sources to check: the driver’s license and an advance health care directive, such as a living will or health care proxy. If the answer is “yes,” the hospital where the person died will have a coordinator to guide you through the process. If your loved one died outside of a hospital — that includes in hospice or a nursing home — contact the nearest hospital. Staff will be on hand to answer questions about what’s next. There is no cost.

Contact immediate family. Of course you want to update key family members. Bringing them together in person, by phone or electronically (via mass email, Skype or Facebook Family page), is an opportunity not only to comfort one another but also to share information about important decisions that must be made — some of them immediately. Do any of you, for example, know of an arrangement for the funeral or other source for burial wishes?

Follow body bequeathal instructions. If the person made arrangements to donate his or her body to a medical school, the family must respect those wishes. An advance directive, living will or health proxy may guide you to a particular institution.

Consider funeral preparations. If possible, bring together key family members for an early conversation. This is especially helpful if the deceased left no advance instructions. Factors to consider:

- What did the deceased want?

- What can you afford?

- What’s realistic?

Choose a funeral home. Most people want a funeral home to transport the body from the morgue to its facility. The deceased may have identified which home to use — and even prepaid for funeral services. If there’s been no conversation about arrangements, the choice will be up to the family.

Notify close friends and extended family. Make a list of as many people as you can. Find contacts through email accounts and personal telephone books. Contact an employer and organizations the deceased belonged to, if necessary. This is an ideal job for a close family friend who wants to help.

Secure property. Lock up the person’s home and vehicle. Is the car parked in a secure and legal area? Will the home be vacant? If so, you may want to notify the police (dial a non-emergency number), landlord or property manager or alarm company. Have someone care for pets until a permanent arrangement is made.

Notify the post office. Use the forward mail option. This will prevent accumulating mail from attracting attention. It can also inform you about subscriptions, creditors and other accounts that need to be canceled.

To Do Before the Funeral

Meet with the director handling the funeral or memorial arrangements. Use instructions your loved one might have left and the earlier family discussion to guide the many decisions to be made.

- Will the body be embalmed or cremated?

- Will there be a casket, and if so, will it be open or closed?

- If body will be cremated, will the ashes be scattered? If the ashes are deposited urn, will it be placed in a mausoleum?

- Where is the burial site?

- Do religious traditions need to be respected?

- Will there be contributions to charities in lieu of flowers?

For a veteran, inquire about special arrangements. A range of benefits can help tailor a veteran’s service. You may be able to get assistance with the funeral, burial plot or other benefits. You can find many details about options at the U.S. Department of Veterans Affairs website. Or call Veterans Affairs at 1-800-827-1000 or your local veterans agency, often included in local government listings. You can also inquire about veteran’s survivor benefits.

Enlist help for the funeral. Relatives and friends may be needed to serve as pallbearers, to create or design the funeral program, cook meals (for a repast gathering or simply for the household of the deceased), take care of children or pets, or shop for any items needed for the funeral or household of the deceased.

Organize a post-funeral gathering. Depending on your tradition, it’s called a repast or a wake. It can be held at the church, a banquet hall or someone’s house. Enlist the help of friends and relatives to plan.

Spread the word about the service. Once a date and time have been set for the service, share the details with those on your contact list. Include an address to send cards, flowers or donations.

Have someone help you make a list of well wishers. Keep track of who sends cards, flowers and donations so that you can acknowledge them later.

Prepare an obituary. The funeral home might offer the service or you might want to write an obituary yourself. If you want to publish it in a newspaper, the funeral home will usually help you check on rates, deadlines and submission guidelines. You may want to put funeral notices in decedent’s hometown paper. Don’t include such details as exact date of birth that an identity thief could use.

To Do After the Funeral

Lists – I made a list of every agency or business that I called with the date and what they needed me to do, even if it was nothing. I have gone back to that list various times and it has been nice to know exactly what I was told and when. I did the same for every catalogue I called to be removed from the mailing list.

Get duplicate death certificates. I have seen many helpful sites suggest you get a dozen death certificates – that’s crazy. They aren’t exactly cheap and you shouldn’t need that many. Start with 4-6 and get more if you need them. Your funeral director may help you handle this or you can order them from the vital statistics office in the state where the death occurred or from the city hall or other local records office. Each certified record will cost in the neighborhood of $10 or $20. (And if you buy 12, that’s $240 the estate can’t get back.)

Send thank-you notes. From the contact list that you acquired earlier, send thank-you notes and acknowledgements. Consider delegating portions of this task to a family member, if you desire.

Bills/Payments. Make a list of regular bills to have as a reminder – be sure to note if any are on automatic payment plans, or note when payments are due. Some examples of bills to locate:

- Utility Bills (electric, heating, telephone, cell phones, water/sewer/garbage, internet, etc.)

- Long Term Debts (home mortgages, Bank Line of Credit, car loans, etc.)

- Rental fees (home, apartment, assisted living, or nursing home, etc.)

- Credit Card and Debit Card bills

- Insurance bills (health, Long Term Care, home, car, life insurance, etc.)

- Property Tax bills (if paid separately and not included in home mortgage)

Banks, Financial Institutions, and Credit Card Companies. If you were a co-signer or had a joint account with the deceased, you must notify the Bank or other Financial Institutions of the death. For joint accounts “with the right of survivorship” the survivor owns all of the money in the account, but you still must notify the bank of the death. Credit card accounts will quickly go to a collections agency if you notify them of the death. Our lawyer recommended that we obtain the balances before we notified the card companies if we could. If you have access to online records printing out a few months worth might be useful for finding ongoing billers.

Power of Attorney. If you were the holder of a Power of Attorney (sometimes called an “attorney-in-fact” or the “agent”) for the deceased, your authority to act under the Power of Attorney ends at the time of death.

Notify local Social Security office. Contact your local Social Security office or the national office, (1-800-772-1213). If your loved one was receiving benefits, they must stop because overpayments will require complicated repayment. Even a payment received for the month of death needs to be returned. If the deceased has a surviving spouse or dependents, ask about their eligibility for increased personal benefits and about a one-time payment of $255 to the survivor.

Handle Medicare. If your loved one received Medicare, Social Security will inform the program of the death. If the deceased had been enrolled in Medicare Prescription Drug Coverage (Part D), Medicare Advantage plan or had a Medigap policy, contact these plans at the phone numbers provided on each plan membership card to cancel the insurance.

Look into employment benefits. If the deceased was working, contact the employer for information about pension plan, credit unions and union death benefits. You will need a death certificate for each claim.

Stop health insurance. Notify the health insurance company or the deceased’s employer. End coverage for the deceased, but be sure coverage for any dependents continues if needed.

Notify life insurance companies. If your loved one had life insurance, appropriate claim forms will need to be filed. You will need to provide the policy numbers and a death certificate. If the deceased was listed as a beneficiary on a policy, arrange to have the name removed.

Terminate other insurance policies. Contact the providers. That could include homeowner’s, automobile and so forth. Claim forms will require a copy of the death certificate.

Meet with a probate attorney. The executor should choose the attorney although you may remain with the decedent’s estate lawyer if that works for you. If there is a will, the Personal Representative or Executor named in it and the attorney will have the document admitted into probate court. If there isn’t a will, the probate court judge will name an administrator in place of an executor. The probate process starts with an inventory of all assets (personal property, bank accounts, house, car, brokerage account, personal property, furniture, jewelry, etc.), which will need to be filed in the probate court.

Contact financial advisers, stockbrokers, etc. Determine the beneficiary listed on these accounts. Depending on the type of asset, the beneficiary may get access to the account or benefit by simply filling out appropriate forms and providing a copy of the death certificate. If that’s the case, the executor wouldn’t need to be involved. If there are complications, the executor could be called upon to help out.

Notify mortgage companies and banks. It helps if your loved one left a list of accounts, including online passwords. Otherwise, take a death certificate to the bank for assistance. Change ownership of joint bank accounts. Did the deceased have a safe deposit box? If a password or key isn’t available, the executor would most likely need a court order to open and inventory the safe deposit box. Most probate courts have administrative rules about steps to access the box of any decedent.

Close credit card accounts. For each account, call the customer service phone number on the credit card, monthly statement or issuer’s website. Let the agent know that you would like to close the account of a deceased relative. Upon request, submit a copy of the death certificate by fax or email. If that’s not possible, send the document by registered mail with return receipt requested. Once the company receives the certificate, it will close the account as of the date of death. If an agent doesn’t offer to waive interest or fees after that date, be sure to ask. Keep records of the accounts you close and notify the executor of the estate about outstanding debts.

Notify credit reporting agencies. To minimize the chance of identity theft, provide copies of the death certificate to the three major firms — Equifax, Experian and Transunion — as soon as possible so the account is flagged. Four to six weeks later, check the deceased’s credit history to ensure no fraudulent accounts have been opened.

Cancel driver’s license. Clearing the driver’s license record will remove the deceased’s name from the records of the department of motor vehicles and help prevent identity theft. Contact the state department of motor vehicle for exact instructions. You may have to visit a customer-service center or mail documentation. Either way, you’ll need a copy of the death certificate.

Cancel email and website accounts. It’s a good idea to close social media and other online accounts to avoid fraud or identity theft. The procedures for each website will vary. For instance, Google Mail (Gmail) will ask you to provide a death certificate, a photocopy of your driver’s license and other detailed information.

Stop catalogues. Register the decedent at the Direct Marketing Association website (www.dmachoice.org). This will stop catalogues and other direct marketing materials.

Cancel memberships in organizations. Reach out to sororities, fraternities, professional organizations, etc., the deceased belonged to and find out how to handle his/her membership status. Greek organizations may want to hold a special ceremony for your loved one.

Contact a tax preparer. A return will need to be filed for the individual, as well as for an estate return. Keep monthly bank statements on all individual and joint accounts that show the account balance on the day of death.

Notify the election board. According to a 2012 Pew Center report, almost 2 million people on voter registration rolls are dead.

Arrange for headstone. You can typically purchase a headstone through the cemetery or from an outside vendor of your choice. Consult the cemetery about rules, regulations and specifications such as color and size, particularly if you go with an outside vendor.

And here’s the link – What to Do When Someone Dies pdf. Best of luck.

{ 2 comments }

So, ok, I’m going to go on a small rant here, one that some may have an issue with since I’m not a parent. But, I’m a child and I have that prospective on this issue.

So, ok, I’m going to go on a small rant here, one that some may have an issue with since I’m not a parent. But, I’m a child and I have that prospective on this issue.

So, you may have heard that a college football player on the verge of being drafted into the NFL came out earlier this week. Michael Sam, a defensive end for Missouri and likely to be picked in the 3rd-5th round of the NFL draft, came out to the media (and the rest of us). He was already out to his teammates and others he was close to. He is, in some ways, an unlikely candidate to be the first openly gay athlete entering his pro career. He is one of 8 children, one who drowned as a 2-year old, one who was shot and killed at 15 breaking into a house, and one who disappeared in 1998 and hasn’t been heard from since. Two of his living brothers are in prison. Suffice it to say that his plan to go to college with his football prowess was predicated on his desire to get out of his hometown and try to stay alive. More power to him, but my peeve is only tangentially related to him.

Yesterday on NPR’s Here and Now, a former NFL player who has since come out as gay, Wade Davis, was being interviewed on the situation. He was at Sam’s press conference supporting his decision. But in response to some comments that Sam’s father had made to the effect that he was uncomfortable with a gay player in the NLF, even if it was his son, Wade said the following;

A lot of people won’t like me to say this, but I’m OK with that. You know, when I came out to my family, it was about three to four years of a really tough time. But I think that we have to sit back and go, like, what is the life of a parent like when their child announces that they’re LGBT.

Oftentimes our parents’ dreams die. So for my mother, when I told her I was gay, this dream that she had for her son has now died. So parents need to time to kind of grieve and to mourn, and everyone grieves very, very differently.

So, here’s my peeve. The idea that parents need time to ‘grieve’ when the dreams they have for their children ‘die’ is a crock of shit. Children are not born to be the repository of their parents hopes and dreams. I’ll give parents two dreams for their children – 1)that they are healthy and 2) that they find satisfaction with their lives. Beyond that, the idea that your children are on this planet to do anything other than live the lives they choose, and that you should somehow need time to mourn that their not doing what you had hoped, is ridiculous. How many bridezillas are created by mothers who are trying to have the wedding that they wanted from their mothers? How many boys (not only but mostly) are pushed into sports by dads who always wanted to be the star quarterback or point guard when the kid wants to participate in band or chess or poetry? How many couples are hounded by their parents and called selfish when they consider that they aren’t interested in having children?

And considering that Sam’s father has lost 5 children to death and prison, how is he grieving his one child that appears to have escaped the toxic environment that he helped create? (It’s possible that he’s not and that Wade is putting words into the father’s mouth, but I’ve heard that line many times about children who decide to reveal that they are gay.)

Parents need to help children find those things that they love, it’s part of growing up. Seeing a child you love find great joy in something they love had to be a wonderful feeling for a parent. But grieving that Sally won’t be a prima ballerina and Scott won’t play football on Friday nights is going a bit crazy. Grieving is something that is part of life, but it should be reserved for things that are really important – like death. And we are entering a world where members of the LGBT community have the same choices to have spouses and families as us boring heteronormative people do. What part of their lives are we supposed to be ‘grieving,’ except the possible discrimination they will suffer from idiots they encounter?

I was lucky that my family was more interested in me finding my place in the world than having me take the place that they had always wanted. But I saw other kids pushed around by their parents (including college students who were told what to major in). Having a child isn’t like creating a robot that you’re got programmed for life; it’s closer to throwing a rock in a pond and watching the ripples play across the surface.

(And, if you’re interested in reading a book about raising children with identities different from their parents, I heartily recommend “Far from the Tree:Parents, Children and the Search for Identity.” It’s a long book, but the insights are deep.)

{ 0 comments }

Ok, so I suppose that we can agree that no one is a real fan of visiting the dentist (except maybe the dentist). But for the most part, my teeth are pretty good, so I don’t have any issues usually. A couple of weeks ago, however, I developed a pain in my upper jaw that was too nebulous to determine if it was tooth or sinus. After a couple of medical visits, it became clear it was a tooth, a wisdom tooth to boot. After a course of antibiotics and a visit to the endodontist to confirm, I was scheduled for a root canal. Now I had a root canal about 20 years ago that went well – I was not in pain, it was a straightforward procedure, and was done in about 2 hours. But I wasn’t looking forward to having another one (but I was happy to not losing my tooth).

Ok, so I suppose that we can agree that no one is a real fan of visiting the dentist (except maybe the dentist). But for the most part, my teeth are pretty good, so I don’t have any issues usually. A couple of weeks ago, however, I developed a pain in my upper jaw that was too nebulous to determine if it was tooth or sinus. After a couple of medical visits, it became clear it was a tooth, a wisdom tooth to boot. After a course of antibiotics and a visit to the endodontist to confirm, I was scheduled for a root canal. Now I had a root canal about 20 years ago that went well – I was not in pain, it was a straightforward procedure, and was done in about 2 hours. But I wasn’t looking forward to having another one (but I was happy to not losing my tooth).

The endodontist said I’d be done in about a hour, and he was spot on. The only pain was one of the shots of anesthesia. My jaw was sore (working that far back is not easy for the Dr. either), and the skin around the tooth is a bit tender, but that’s about it. But I was curious as to why this procedure took so much less time. Well, for one thing tiny bits (the size of 2-3 human hairs) allow the roots to be removed with the drill, a much faster way than hand filing. Also, they have to take less of the tooth surface down because they can use these bits. The new drying agents and fillers are much easier and faster than their predecessors. And digital X-rays have speed up that process a lot. As Dr Wood (might as well use his name) said, a basic root canal is like a large filling. I’ll have to have a crown made and fitted, but things look good.

One unusual thing with my tooth – this tooth had three roots (many do). However, one of those roots had completely walled itself off from the tooth in a process that Dr Wood said is like a self root canal. He said it’s not an uncommon strategy for the nerve to try to wall itself off from the tooth in an effort to protect the tooth from infection. However, it means that this tooth has been heading to death for a while. This condition lowers my chances of a good outcome by about 5%, but hopefully it’ll all work out.

The interesting thing is that technology has moved on in the background to make procedures (root canals and others outside of dentistry) that used to be considered horrible much quicker and less painful. Now, it’s not like a cure for cancer, but keeping one’s teeth cannot be underestimated. Both my grandparents lost their teeth in their 60s, and they continued to be a source of pain and trouble for the rest of their lives. And food isn’t all that tempting when your mouth hurts.

Take care of your teeth – you only get one permanent set.

{ 0 comments }

When we bought Pedzwell last year, we knew that we wanted to change the front yard, especially removing the grass. We had a local consultant help us create a plan last fall that was based on local Colorado plants or those that would naturalize and need much less or no water. So, on Tuesday last (as they say), our contractor and his workers arrived.

This is what they found. We had never restarted our sprinklers, so the grass wasn’t doing so well. There had been bushes in front of the porch (planted by the previous owner), but they never came back after our first winter. We were later told by our consultant that they didn’t get near enough sunlight in that spot. He had clearly just planted them to sell the house.

This is what they found. We had never restarted our sprinklers, so the grass wasn’t doing so well. There had been bushes in front of the porch (planted by the previous owner), but they never came back after our first winter. We were later told by our consultant that they didn’t get near enough sunlight in that spot. He had clearly just planted them to sell the house.

The first two days were pulling out the grass, shrubs, and rocks.

Days Three and Four included dirt moving and the beginnings of retaining walls.

Days Five and Six sees things coming together.

And at the end of Day Seven, we have a lovely front yard, that we hope to enjoy for years to come.

Update: Stan pointed out that I should mention the folks who did the work. Our original consultation was withEve Reshetnik Brawner, the co-owner of Harlequin’s Gardens in Boulder (a great place for local plants and assistance with such). The company that brought the plan to life and made the final choices for plants and placement was Art of the Land with Paul Briggs as onsite supervisor. The company that did the demolition of the old yard, planting, and placement of stones and water system were Isidro and his guys from IRV Landscaping LLC. Everyone was great and we’re really happy with the work. Now we just get to watch it grow.

{ 0 comments }

Even in a select group of individuals such as astronauts, this guy is special.

{ 0 comments }